Socials

PayPal’s relationship with Nigeria has been unpleasant for users in the country since the early 2000s. In 2004, they officially restricted Nigerian accounts from receiving funds.

For nearly two decades, Nigerians, especially freelancers, remote workers, solopreneurs, and digital professionals could receive and spend money using their Nigerian PayPal, but withdrawal was impossible, making the Nigerian PayPal almost useless. It didn’t feel right for a nation of young and vibrant minds to be shut out of the global economy, as PayPal still remains the easiest, most convenient and preferred method for clients wanting to pay digital professionals across the globe.

This created a massive “shadow economy” where Nigerians used VPNs and foreign phone numbers to open “Lesotho” or “UAE” accounts, only to have their funds frozen without warning. Even here on our YouTube channel, I teach our audience how to create a US LLC to then use that entity to create PayPal, Stripe, and even US bank accounts. This has been my preferred approach for running my own online business and accessing PayPal and other services like it that have shut Nigeria out for many years.

Now, in early 2026, the big headline is that PAYPAL IS BACK! But there are still lingering questions like:

-

Are they fully back and operational?

-

What is the real reason PayPal stayed away all these years in the first place?

-

Is the current return well executed or just a candle in the wind like we saw with Flutterwave in 2021?

-

Should you confidently rely on PayPal now or move with caution?

Why PayPal Left and Why They Are Now Back

Many Nigerians felt PayPal’s exit from the Nigerian space was a targeted insult, with some, myself included, making the argument that Nigeria is not the only fraudulent country. In fact, the US is about twice the population of Nigeria, and with that size comes a fair share of everything, both good and bad, fraudulent activities included.

But if we put our emotions aside and look at things logically, we can see the real reason why PayPal’s decision to stay away from countries like Nigeria may not simply stem from racism and systemic exclusion. After some digging and thinking, these are the three major reasons why PayPal left Nigeria and why they are now returning.

1. Fraudulent Activities / High Risk Low Reward

The obvious and most front facing reason is, of course, fraud. In 2004, Nigeria accounted for 4.81% of global internet fraud (ranked 3rd globally at the time). For a company that survives on trust, those numbers were a red flag for PayPal.

But it’s not just about how much money is stolen. Like we’ve established, the US is equally fraudulent. It’s about the ratio of loss compared to the total money moving through the system. Think of it like two different shops:

-

Shop A (The “Old” Nigeria): You sell $10,000 worth of goods, but $3,000 is lost to fraud. That is a 30% loss. It is a nightmare to manage, and most owners would simply close the shop and blacklist the area.

-

Shop B (The United States): You sell $10,000,000 worth of goods. Even if you lose 30% to fraud, that is $3,000,000 lost. On the surface, a loss of 3 million is way bigger than $3,000, but then a profit of $7,000,000 is also way bigger than a measly $7,000.

So Shop B is a much better business, and Shop A is high risk, no reward. For a long time, the world saw Nigeria as Shop A: small volume but high fraud percentage. Today, our economy is different. In 2024 alone, Nigerians processed over $750 billion in domestic payments.

With billions of dollars now flowing through our systems every month, the “bad” transactions have become a tiny drop in a very large ocean. PayPal realized that even if some fraud still exists, the 99% of honest Nigerians moving massive amounts of money make the market way too profitable to ignore any longer.

2. Lack of Enabling Systems

PayPal, being a US company, is used to operating in highly systemized environments, and Nigeria has lacked systems in many areas. There was no clear system of identification to match the Social Security Number (SSN) system in the US, which is crucial for the financial sector to identify customers and investigate disputes or fraudulent activities. Now we have the Bank Verification Number (BVN) and National Identification Number (NIN). KYC (Know Your Customer) is also now strictly enforced. Pair that with the various means of identifying individuals and you see that we are slowly beginning to have a system, at least in the area of identification. These systems are not perfect yet, but they are a step in the right direction, obviously increasing trust in investors.

3. Compliance

A few years ago, I worked with an Indian fintech company that was trying to build a product for the Nigerian market. Less than a year after launch, they packed up and left. All I kept hearing from everyone involved in the project was “compliance.”

Nigeria’s regulatory environment was notoriously tough for foreign tech firms to navigate without a local physical presence, which further explains why PayPal keeps trying to return to Nigeria through partnerships instead of making a direct entry.

The “Tax Reform” Factor (My Conspiracy Theory)

Now I know this line of reasoning might make me sound like a conspiracy theorist, but it just feels like too much of a coincidence that just as the Nigerian government has embarked on these major tax reform, actively pushing the Nigeria Tax Act 2025 and talking about widening the tax net to capture digital professionals and content creators who make money online, PayPal suddenly decides to return through a partnership with a local company.

It all feels like the government wants online earners to use the Nigerian PayPal accounts, which are now directly linked to your BVN and NIN. It’s the perfect setup for them to get more accurate data on how much online earners are really making. Call me a conspiracy theorist, but this is just the angle I’m seeing things from. I truly believe the timing of the tax reforms and PayPal’s sudden return is no coincidence. It’s about visibility, and for the first time, the “tax man” has a front-row seat to our global earnings.

PayPal’s 1st and 2nd Return: From Flutterwave to Paga

Now that you know the background of PayPal’s toxic relationship with Nigeria, let’s return to the main headline of PayPal returning back to Nigeria. This is not actually the first time they’ve attempted a comeback. In 2021, a PayPal x Flutterwave partnership was announced to much fanfare. However, for most of us “on the ground,” it was not the glorious second coming they hyped it up to be.

I remember trying the Flutterwave integration in 2021. It felt like a “Frankenstein” setup. You had to create an invoice on Flutterwave, the client paid via PayPal, and the interaction was just clunky. It wasn’t a real PayPal integration; it was more like an invoice collection service. I successfully used it a few times with one client that was willing to go through the trouble with me before the system became so buggy I simply gave up.

The 2026 Paga Integration

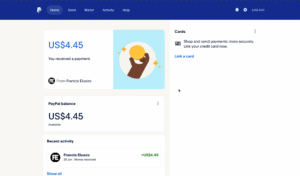

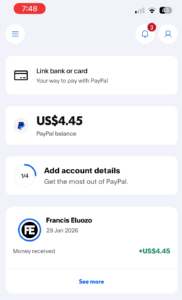

The current return via Paga (announced in January 2026) feels different. I’ve been testing it and unlike the 2021 attempt, this is a deeper integration.

-

Linking: You can create a Nigerian PayPal account and a Paga wallet and link your PayPal directly to your Paga wallet. You only need to send your PayPal email to anyone who wants to pay you. Once they make the payment, you see the transaction on both your PayPal account and your Paga wallet. Most importantly, the sender does not have to deal with Paga, an unfamiliar platform; only you have to use Paga for withdrawal.

-

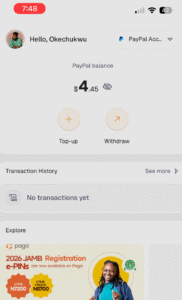

Withdrawal: For the first time in a long time, you can withdraw your PayPal USD directly into your local bank account by converting the funds in your Paga wallet.

I was able to set up my PayPal and Paga accounts, fund my PayPal wallet, see the money reflect in my Paga wallet, and convert it to my local bank account in literally minutes. I cover this in detail in my latest YouTube video.

Why This PayPal Return Feels Unexciting

Even though the Paga partnership works, there is a reason some of us aren’t celebrating yet. PayPal is still using a middleman (Paga) to handle the risk. This shows that PayPal still doesn’t trust the Nigerian market enough to offer a direct, native service like they do in, say, Kenya or South Africa.

By using Paga as a buffer, PayPal offloads the “dirty work” of KYC, fraud monitoring, and local settlement. While our tech scene is booming and systems like BVN have reduced fraud significantly, the “Nigeria Risk” tag hasn’t been fully removed; it’s just been outsourced. Whether they will ever do a full integration, allowing Nigerians to use the PayPal platform directly without a local bridge, is a question only the future can answer.

In the section where I talked about why PayPal left and why they are now returning, it may seem like I was playing devil’s advocate and defending PayPal, but I was only trying to be fair and cover both sides of the story so that we have a complete understanding of the situation.

The truth is, I don’t trust PayPal. It’s one of the most polarizing fintech companies on the planet, and like most big corporations, they don’t do anything that is not for their profit. That said, I will advise you not to get overly excited about PayPal’s return. Only time will tell if the intentions are pure. There are lots of reports and complaints on X (formerly Twitter), with many Nigerians claiming they had their PayPal accounts permanently restricted after creating them, so confidence has not been fully restored, although that has not been the experience for me.

For those of us who have US PayPal accounts using a US LLC, you might wonder what to do now. Should you dissolve your US LLC? I can’t decide for you, but for me, I’ll be holding onto mine for a while. In fact, I just recently renewed my registered agent for my LLC and am filing my tax return for 2025. Even though I can confirm that this PayPal return is highly promising and might last, knowing PayPal and its history with Nigeria, I will be holding on to the other assets I’ve already built my business on while keeping an eye on the progress of the comeback.